Recent reports on an emerging drug kingpin-converted mining tycoon becoming Beijing’s man in Kabul reveal a chain reaction of corruption in Afghanistan’s mining industry. However, how the Chinese operate in the mining industry in Afghanistan remains unknown. Based on open-source research, intensive interviews, and frequent field work, this article uncovers the secret operation of Chinese traders in a major placer gold mine in Afghanistan – the Samti in Takhar province. Research findings suggest that the Chinese gold rush in Afghanistan is changing the mining industry into real estate business.

Attention to the Samti mine is attributed to its estimated 30,000 kilograms of gold deposits. Last year, Afghanistan’s Ministry of Mine and Petroleum (or MoMP) under the Taliban rewarded this mining contract to an newly established Afghan-Chinese joint venture, claiming that the company agreed to pay 56 percent of its production to the Taliban government. The steep high royalty/tax has astonished professional mining companies: in even more secure countries with better infrastructure and connectivity to world market, the royalty rate ranges from 3% to 18% (of production) worldwide, if taxed on production.

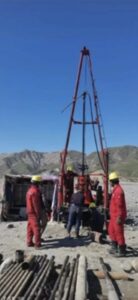

This high royalty invites greater scrutiny into the nature of the Chinese mining projects in Afghanistan. Since the signing of the contract in late August 2023, the Chinese partner in this Afghan-China joint venture, marked as “CDC,” shipped GY-150 core drills in November from China to Afghanistan and started drilling in late December. Now, three core drills are being deployed to carry out “exploration”.

The GY-150 core drill is one of the most used drills in China’s agriculture and construction industries, extracting sample rock or soil from the underground for lab analysis of soil or rock composition. From a Chinese website, the price for this core drill ranges from $4,000 (basic model) to $10,000 (with moveable chains and other auxiliaries). This core drill is not designed for exploring placer gold mine due to the fact that it is unable to bring up enough ore for quantitative analysis of grade and deposit of placer gold mines.

It is curious to ask why the Chinese deploy three core drills unfit for placer gold mine to operate in Samti. There are three possibilities account for this strange practice: the first possibility is that the Chinese have no rudimentary knowledge about exploring, not to mention developing, placer gold mines. The second possibility is that the Chinese are knowingly, purposefully, and symbolically carrying out the exploration with this drill to show the Taliban government that they are working to follow the contract timeline. The third and worst scenario is, by adding gold to the sample ores, fabricating exploration data to “prove” the existence of developable grade and large amount of gold deposit.

The logic behind this practice is that some Chinese traders often win a contract (with a powerful local backer) by promising impossible high royalty rate and by paying a small security deposit. Then they deploy cheap and unprofessional drills (in this case, core drills) to fabricate data during exploration. The final goal is to sell “proven,” “rich” mineral mines to potential developers or investors.

It’s a common sense for people familiar with placer mining that core-drilling is unable to test the grade and quantity of gold deposit, but core drilling process can provide a cover and opportunity to fabricate data: buying gold from nearby site and secretly adding to extracted sample ores. Coupled with adding gold to extracted sample ores, standard practices also include the making of “scientific” coordinates, maps, and table to support their fabrication. The lack of credible and authoritative Afghan administration and mining experts to monitor and record this drilling process further facilitates this fabrication, making the exploration data completely untrustworthy and fake.

It is interesting that when the Afghan-Chinese joint venture won the bidding in late August of 2023, there is no sign that it would develop the Samti mine from the beginning. Only from November did the venture begin to ship this well-digging drill to Afghanistan to extract placer gold. The only progress this joint venture has made to date is to increase the number of this core drill to three or four, with a total machinery cost of less than $30,000. Understandably, on January 27, 2024, the Chinese requested the MoMP to extend exploration license for another six months, hoping to generate the “testing” data in next six months by deploying core drill. To date, the drills in the Samti already stopped due to doomed mechanic failure of this kind of drills, as predicted. The MoMP and the Afghan-Chinese joint venture probably knew it from the very beginning, if they possess basic mining knowledge on placer gold mines.

From a mining industry’s perspective, any professional exploration of the Samti will cost more than one year and around ten million US dollars. Some estimate that the Samti contains about 30 tons of placer gold in an area of 6000 meter long and 1000 meter wide. To get the professional exploration result, standard practices require deployment of professional and specialized drills (not core drill for agriculture and construction industries) and digging hole in every 500 or 600 meters long (and thus 10 to 12 rows are divided) and 30 meters wide (distance between the roles in one row). The minimum number of holes that need to be drilled is between 300 and 360. If the average depth of a hole is 40 meters, then the total exploration length is between 12,000 and 14400 meters (or 12 to 14.4 kilometers).

The exploration cost is thus can be roughly calculated. The average cost for drilling 1 meter deep is about $300 and the minimum risk investment for 12 to 14.4 kilometers is $3.6-4.32 million. Without professional drilling equipment, mining expertise, and mining management, no company (other than professional mining company with expertise in placer mines in a rocky riverbed) would invest $4 million just for exploration. That’s why no exploration has been carried out in 20 years. Only for professional mining companies technically and financially capable of developing placer mines like Samti, multi-million-dollar exploration as a risk investment could be possible before pouring hundred million dollars for development.

The Samti mining contract and current amateur practice reveal that the Taliban top leaders and their associates display reveal the nature of the Chinese Afghan joint gold rush in Afghanistan is simply cash-seeking. The Afghan government, including the MoMP and Hajj Bashir, might earn some quick cash either in the form of security deposit or share-selling. In short, in today’s Afghan mining industry, both the MoMP and the investors like the above-mentioned Chinese one have traded, not to intend to develop, the mineral mines for quick cash.

The Chinese have in turn attempted to re-sell or retail its share to Chinese investors or developers. For the short term, this cash-making strategy may benefit the Afghan top leaders and their associates that all parties have not intended to develop the mine, but convert the mining industry to real estate business with the Chinese partners for sell and re-sell: everyone tries to obtain the contract and sells to others for quick cash, everyone expects future developers to pay unpayable royalty, but no one is intended or capable to develop.

This real estate nature of the mining industry in Afghanistan, as exemplified by the Samti, explains why the contractors go too far as to promise to return 56% of the production to the government. On the contrary, the royalty of the Samti mine under the former Kabul regime was 20% of the production based on 85 % purity (in reality, it’s about 25 % of the total production), which is still too high by the international mining standard and former President Ashraf Ghani had to reduce half of this royalty).

This high royalty rate had not led Afghan traders to develop the Samti mine in the past decade. Even when the former Kabul government further lowered the loyalty rate, nobody invested simply because even the risk investment for exploration is too costly. Now, the royalty rate is more than tripled and the transaction are multiplied, making it impossible to develop. The professional developers would not bite the bait of the Afghan Chinese to invest or develop under the current terms and practices.

On the contrary, the current Afghan-Chinese gold rush and the random and unprofessional drilling will damage the Samti mine as a whole, making the Samti less valuable and creating more problems. The Taliban government will not receive any percentage of the production simply because this gold rush is not intended or capable to develop the Samti mine, as demonstrated by their deployment of unprofessional core drills. Converting the mining industry to real estate business through contracting and sub-contracting would have eventually destroyed the waning reputation of the Taliban government and the Afghan mining industry had remedies not been made timely.

Since the joint venture is unable to develop or even to explore the placer gold mine, the most common Chinese mining practice, as we have observed in China, Africa, and other countries and regions, is to produce some fake data by inserting purchased gold into the simples and thus claim to the potential buyers (not the Afghan government) that the deposit is abundant. Thus, we see the contradictory phenomenon that on the one hand, the Chinese side complains about the exaggeration of the deposit while on the other hand, it makes faked sampling data in an attempt to sell to other developers or investors. However, the cash game between the MoMP and traders (in this case, the Chinese company) and the faked data produced by the latter will scare away potential professional investors or developers.

Samti contract under the former Kabul regime: 20% royalty based on 85 % purity.

The views expressed in this article do not necessarily reflect Wesal TV’s editorial policy.

Views: 275